The Q2 results of PVH showed a massive fall of 33% in YOY revenue and that was the closest quarter when the Pandemic started to subsided globally. The reason for adverse growth in revenue was self-evident, in Q3 also, the company is still struggling to reach pre-covid sales figures , however the signs of recoveries are very apparent and encouraging as well. On an international level, the sales are very close to the pre-covid level however the North American Region has been struggling and generating revenue up to 60-65%.

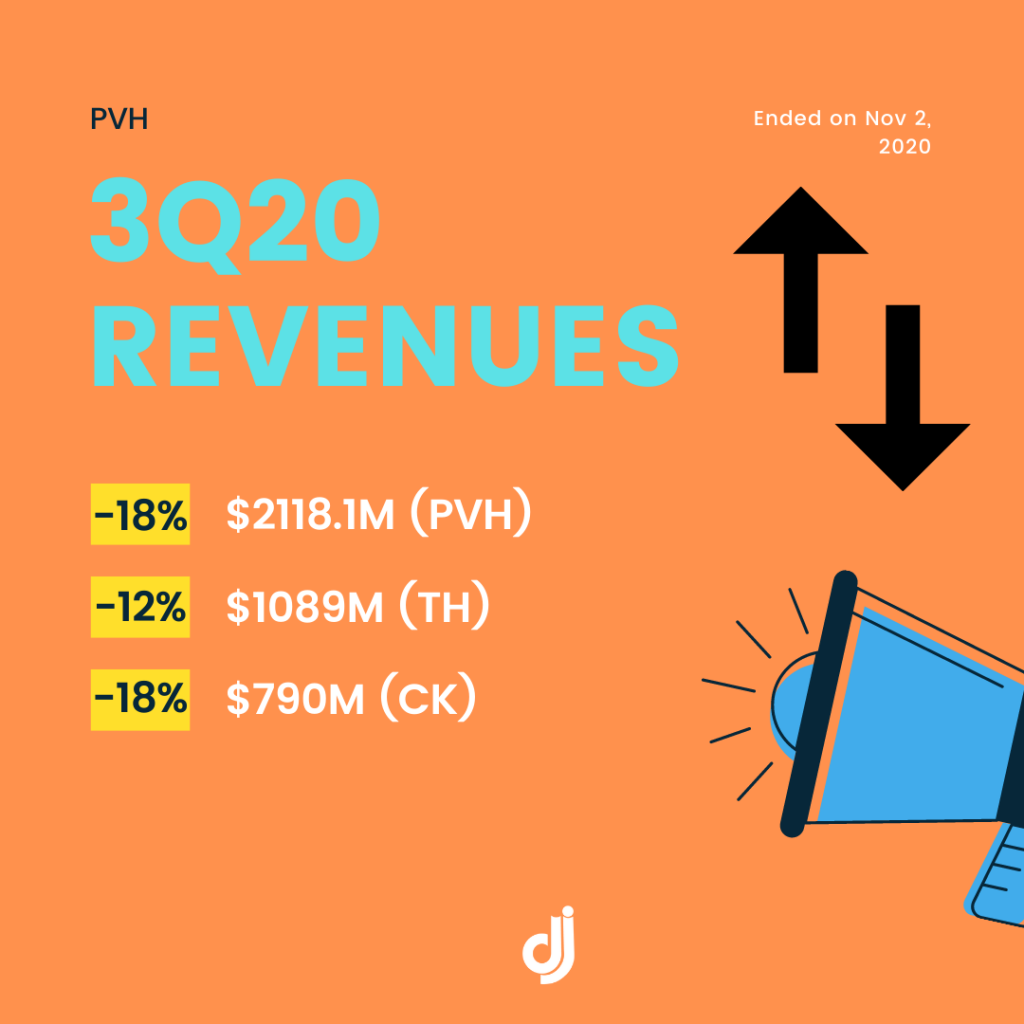

In Q3, total revenue decreased by 18% to $2.118 billion compared to the prior-year period. The company believes it as a sequential improvement compared to the percentage of revenue decreased in the prior two quarters. The Company’s revenue through digital channels grew 36%, with sales through its directly operated digital commerce businesses up 70% compared to the prior-year period.

Before we go into deep dive of the Q2 results, here is the snapshot of Q3 earnings.

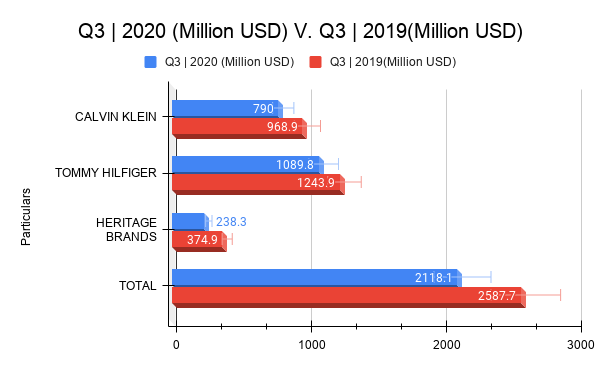

Revenue Distribution – Brands

Looking at the brand-wise revenue distribution, Tommy Hilfiger is leading the revenue chart with USD 1089.8 million accounting for 51.45% of the total revenue share. Calvin Klein with USD 790 million is the second in the revenue chart accounting for 37.29% of total revenue.

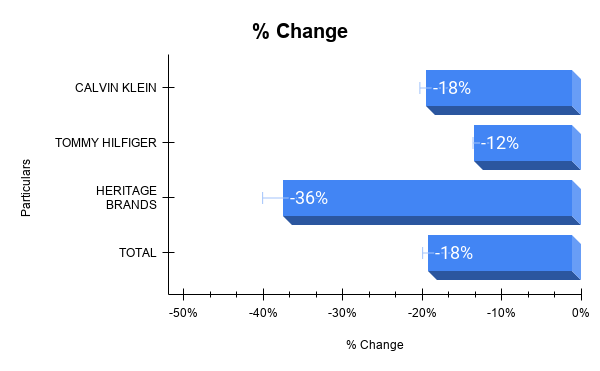

Comparing the same period from the previous year, both brands Tommy Hilfiger and Calvin Klein have registered a massive fall of 12% and 18 % respectively. Overall, the total revenue contracted by 12% which amounted to a total revenue loss of $469 million.

| Particulars | Q3 | 2020 (Million USD) | Q3 | 2019(Million USD) | Change((Million USD) | % Change |

| CALVIN KLEIN | 790 | 968.9 | -178.9 | -18% |

| TOMMY HILFIGER | 1,089.80 | 1,243.90 | -154.10 | -12% |

| HERITAGE BRANDS | 238.3 | 374.9 | -136.6 | -36% |

| TOTAL | 2118.1 | 2587.7 | -469.6 | -18% |

Revenue Distribution – Regions

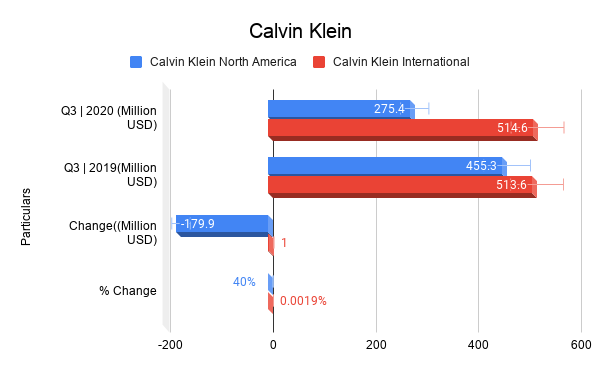

Calvin Klein

Analysis of the regional distribution of revenue of Calvin Klein shows that revenue from the North America region saw a decline of up to 40% during Q3 2020, revenue fell from $455 million to $275. million. Internationally, CK revenue came back to pre covid level and has shown a positive growth of $1 million.

| Particulars | Q3 | 2020 (Million USD) | Q3 | 2019(Million USD) | Change((Million USD) | % Change |

| Calvin Klein North America | 275.4 | 455.3 | -179.9 | -40% |

| Calvin Klein International | 514.6 | 513.6 | 1 | 0% |

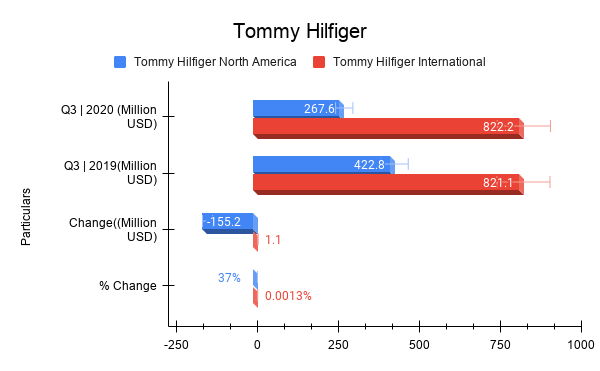

Tommy Hilfiger

The highest-grossing brand of PVH- Tommy Hilfiger has a similar story, its North American operation has reported a fall of 37% % in its revenue during Q3,2020 however international revenue witnessed a slight growth of $1.1 million.

| Particulars | Q3 | 2020 (Million USD) | Q3 | 2019(Million USD) | Change((Million USD) | % Change |

| Tommy Hilfiger North America | 267.6 | 422.8 | -155.2 | -37% |

| Tommy Hilfiger International | 822.2 | 821.1 | 1.1 | 0% |

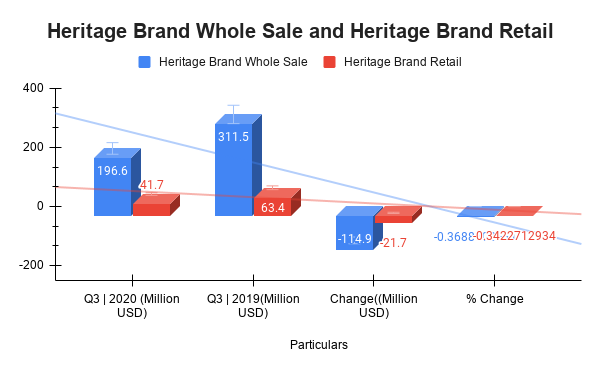

Revenue Distribution – Channels

Whole Sale Channel is beating the retail channel in terms of revenue distribution of Heritage Brands by big margins. Where Retail Channel contributed USD 41.7 Million, the wholesale channel of Heritage Brand contributed USD 196.6 million during Q3,2020 however both channels were hugely affected and fell up to 37% during this quarter ended on Nov 2, 2020.

| Particulars | Q3 | 2020 (Million USD) | Q3 | 2019(Million USD) | Change((Million USD) | % Change |

| Heritage Brand Whole Sale | 196.6 | 311.5 | -114.9 | -37% |

| Heritage Brand Retail | 41.7 | 63.4 | -21.7 | -34% |

The Company anticipates its fourth-quarter revenue and earnings will continue to be negatively impacted by the COVID-19 pandemic; although there is uncertainty due to resurgences throughout Europe and North America, the Company currently expects revenue in the fourth quarter to decline approximately 20% compared to the prior year.

We are regularly publishing reports on various aspects of the denim business globally including :

- Exports and Imports

- Market Intelligence

- In-depth market analysis on important importers and exporters

- Updated information on different markets.

We have published over 215 reports till now and we expect to publish over 40-50 reports in 2021 as well. You can check all our reports at- https://www.denimsandjeans.com/subscriber-only-reports-3 .

The annual subscription to our SPECIAL REPORTS enables access to all 215 previous reports and also to all new reports that we shall be publishing in 2021. Please do contact us for a subscription in case you find these reports useful for your business purposes.

Email- mktg1@denimsandjeans.com